Irs Loans From Shareholders

S corporation owners can take money out of the corporation in a variety of ways.

Apr 06, 2020 Purported “loans” from S corporation to its sole shareholder, officer, and director, were wages for purposes of FICA and FUTA taxes. The loans were unsecured demand notes bearing no interest, loans were made entirely at the discretion of shareholder, and the shareholder regularly performed substantial, valuable services for taxpayer.

- Nov 21, 2017 You can make de minimis loans of $10,000 or less to shareholders without the payment of interest. But, if all of the loans from the business to a shareholder add up to more than $10,000, the advances may be subject to a complicated set of below-market interest rules unless you charge what the IRS considers an “adequate” rate of interest.

- If the loan is not repaid in time, the full principal amount of the loan must be included in the shareholders income. For example, if the corporation’s taxation year end if December 31 st and it loaned money to the shareholder on January 15, 2015, the shareholder would have until December 31, 2015 to repay the loan without it being included.

Wages

S corporation shareholders who work for the business (shareholder/employee) are classified as employees and receive the same tax treatment as any other employee who works for the business who is not a shareholder (i.e. a paycheck is issued, taxes are withheld, employment taxes are paid, a W-2 is issued).

Shareholders who work for the S corporation should receive reasonable compensation for the type of work being performed.

Distributions from S corporation Earnings

When a regular C corporation distributes its earnings out of its retained earnings, the distribution is called a dividend. C corporation shareholders (and the IRS) receive Form 1099-DIV, which is issued by the C corporation to report the dividend. C corporation shareholders report the dividend on their individual income tax return.

On the other hand, with certain exceptions, S corporations generally do not make dividend distributions. S corporations generally make non-dividend distributions, which are tax-free, provided the distribution does not exceed the shareholder's stock basis. If the distribution exceeds the shareholder's stock basis, the excess amount is taxable as a long-term capital gain.

S corporation distributions are not subject to FICA taxes (social security and Medicare taxes).

Imputed Interest On Shareholder Loans

When An S corporation Distribution May Be Taxed As a Dividend

Although S corporations generally do not make dividend distributions, there are some exceptions when an S corporation distribution may be taxed as either a dividend or as a long-term capital gain.

Let's say a business started its existence as a regular C corporation and operated that way for several years. Then, the decision is made to convert from a C corporation to an S corporation. In addition, at the time of conversion the C corporation had $10,000 in retained earnings.

After the conversion, if that $10,000 in pre-S corporation retained earnings is distributed to S corporation shareholders, each shareholder would report his percentage share of the distribution as dividend income on his personal income tax return.

For example, if there are two S corporation shareholder/employees, each owning 50% of the stock of the company, each would report $5,000 as dividend income on his personal tax return.

In addition, since an S corporation shareholder who works for the S corporation is classified as an employee rather than as a self-employed person, distributions are not subject to employment taxes (i.e. social security and Medicare taxes, state unemployment taxes, federal unemployment taxes).

S corporation Distribution Treated as Long-Term Capital gain

Another situation, touched on previously, where a distribution from an S corporation may be taxed is when an S corporation shareholder receives a distribution that is is greater than the shareholder's stock basis. The difference is treated as a long-term capital gain.

For example, if a shareholder's stock basis is $10,000 and the shareholder receives a distribution of $12,000, the excess distribution of $2,000 would be reported as a long-term capital gain, subject to long-term capital gain tax treatment.

Caution!

S corporation distributions are generally tax free, with certain exceptions previously cited. However, if you're an employee of your S corporation and you're thinking about taking all the money out of the S corporation as a distribution to avoid employment taxes, rather than taking a reasonable salary and paying employment taxes, keep in mind, the IRS and the Social Security Administration are well aware of this ploy.

You can minimize employment taxes by taking a salary in the lowest reasonable amount for the type of work you perform for the business.

Determining a reasonable salary may be done by comparing the average wages paid in the marketplace for similar work. If your business is new (one or two years old) and earnings are low or you're losing money, a lower than market salary can be justified.

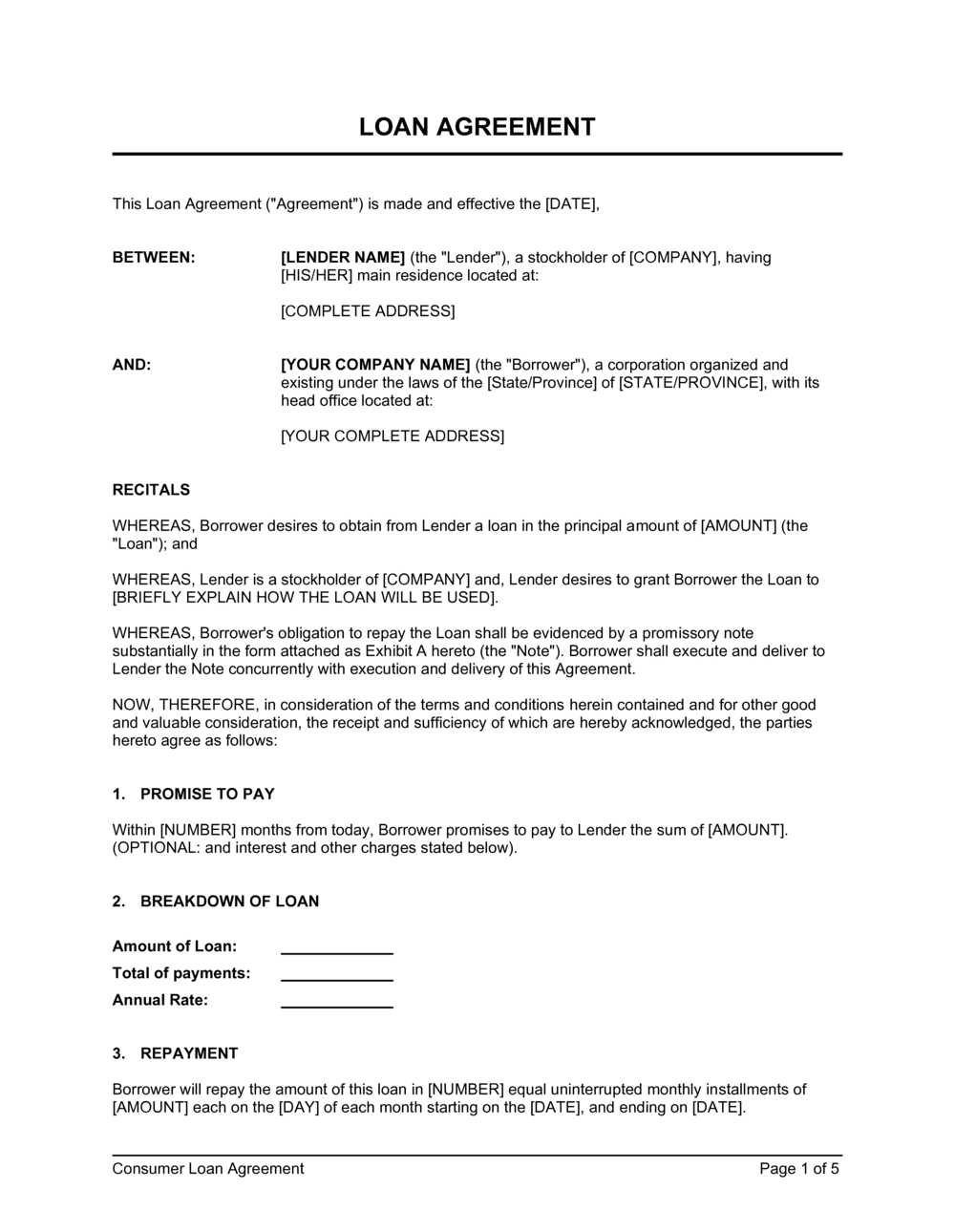

Loans

S corporation shareholders may borrow from the business.

A promissory note should be prepared and properly executed. The note should include normal lending terms. For example, a fair market interest rate, unconditional promise to repay, and a date certain for repayment.

Reimbursement of Expenses

If you spend your own money on business-related items and intend to be reimbursed by the S corporation, be sure to provide the documentation to support the S corporation's disbursement to you.

Loans From Shareholders Irs

|

|---|

Have an accounting or bookkeeping question?Email it to me.

Related Content

Irs Loans From Shareholders Vs

- Return to the Tax Basics for Startups Table of Contents to find related links.